4 Potential Economic Crises You Should Know About

2. Student Loan Bubble

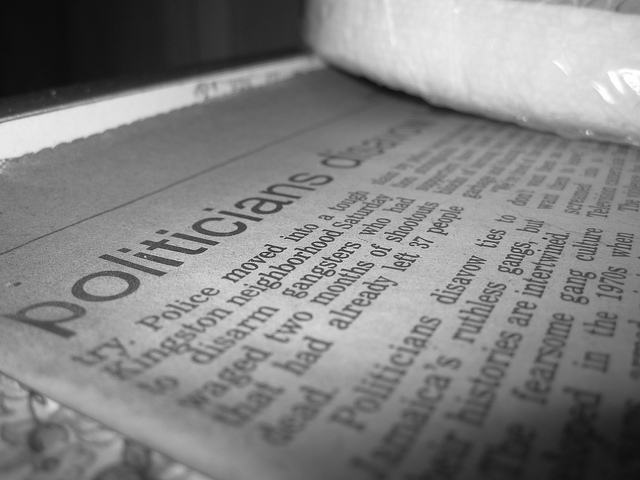

Remember when the housing bubble popped? It sent waves of havoc through the world economy. That may pale in comparison to the student loan bubble. At present, there is over $1 trillion in outstanding student loans in the United States, accounting for the source of the nation’s second largest household debt. Default rates are at record highs and climbing. 1 in 7 borrowers default on their student loans. Major banks such as JPMorgan are already bailing out of the troubled market.

What’s the government doing? Continuing to hand out sub-prime loans to students regardless of their grades, the value of the degree they’re seeking or the institution they’re attending, or any other factor that may determine the borrower’s ability to repay. Many of today’s students, encouraged by a cultural that says everyone should attend college, are incredible credit risks who would never receive loans without government involvement. Sooner or later it the federal government will probably ask the tax payers to absorb the costs of this failed initiative.

Boomer retirement will open up jobs for people.

Depends on the actual job. Some jobs will never ever come back.

Search for “education bubble” and you’ll get lots of hits. Hopefully MOOCs will help burst this bubble.